LNG IPO: Venture Global Debuts $25 Per Share IPO Marks Major Milestone for LNG Leader

Venture Global, a prominent player in the U.S. liquefied natural gas (LNG) sector, has officially announced the pricing of its initial public offering (IPO). The company is set to offer 70 million shares of its Class A common stock at a public price of $25.00 per share. Trading is expected to begin on January 24, 2025, on the New York Stock Exchange under the ticker symbol “VG.”

Key Details of the IPO

The IPO includes an option for underwriters to purchase an additional 10.5 million shares within 30 days, potentially increasing the total offering size. The closing of the offering is anticipated on January 27, 2025, pending customary closing conditions.

Goldman Sachs & Co. LLC, J.P. Morgan, and BofA Securities are leading the book-running management team for this offering. They are joined by a consortium of other major financial institutions, including ING, RBC Capital Markets, Scotiabank, and Deutsche Bank Securities. Co-managers include National Bank of Canada Financial Markets and Raymond James, among others.This IPO marks a significant step for Venture Global as it transitions into public markets while reinforcing its position as a leader in LNG production and export.

About Venture Global

Venture Global is known for its long-term commitment to providing low-cost LNG sourced from North American natural gas basins. The company operates across the entire LNG supply chain, from production to transportation and regasification.

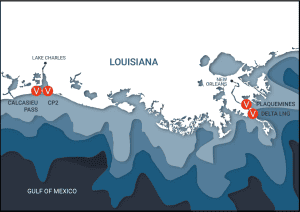

- Key Facilities:

- Calcasieu Pass: Began LNG production in January 2022.

- Plaquemines LNG: Achieved first LNG production in December 2024.

Currently, Venture Global is constructing and developing over 100 million tons per annum (MTPA) of nameplate production capacity. This capacity aims to meet growing global demand for clean and affordable energy.Additionally, Venture Global is investing in Carbon Capture and Sequestration (CCS) projects at each of its facilities to further reduce greenhouse gas emissions and align with global decarbonization goals.

Why This IPO Matters

The IPO comes at a pivotal time for the energy sector as global markets increasingly prioritize cleaner energy solutions. Venture Global’s focus on low-cost LNG and carbon capture technology positions it as a key player in meeting these demands.Key Implications:

- The IPO will provide capital to support ongoing projects and expand production capacity.

- It underscores the growing importance of LNG as a transitional fuel in the global energy mix.

- Venture Global’s public listing will likely increase transparency and attract more investors to the LNG sector.

Future Outlook

With its robust infrastructure and focus on innovation, Venture Global is well-positioned to capitalize on rising global demand for LNG. The company’s commitment to sustainability through CCS projects also aligns with broader industry trends toward decarbonization.

As trading begins under the symbol “VG,” all eyes will be on how this IPO impacts both Venture Global’s growth trajectory and investor sentiment in the energy market.

Source: Venture Global

Read more about:Key Developments in U.S. LNG Policy